Driving Change: What Sport Can Learn from Uber on Finding Its Route to Profitability 🚕

With digital transactions reaching $14.78 trillion by 2027 and influence of traditional sponsorship waning, rightsholders need to start thinking more like Uber and less like the black cabs of London.

Not yet a subscriber? Join 1000+ sports business leaders, from the PFL to the Premier League, that read Sports Pundit every week to get impactful industry insights.

BIG IDEA

Digital transactions are expected to hit $9.46 trillion this year and projected to skyrocket to a staggering $14.78 trillion by 2027. However, the world of sports has yet to fully capitalise on this burgeoning digital economy.

Michael Broughton, a seasoned Sports Industry Consultant & Advisor, highlighted this disparity in a recent video monologue he shared on LinkedIn.

“Sport is one of the main attention grabbers in the world but it's disappointing when it comes to digital monetisation,” he stated.

“It would be the wrong assumption to think that fans, our customers, are not open to doing digital transactions… To me, that would be a bit like the London black cabs back in the day when they continued to only take cash, refusing to allow you to tap your card and then wondered why on earth everybody [had] moved to Uber.”

So, perhaps Uber can also provide the sports industry with some further clues of where the puck is heading?

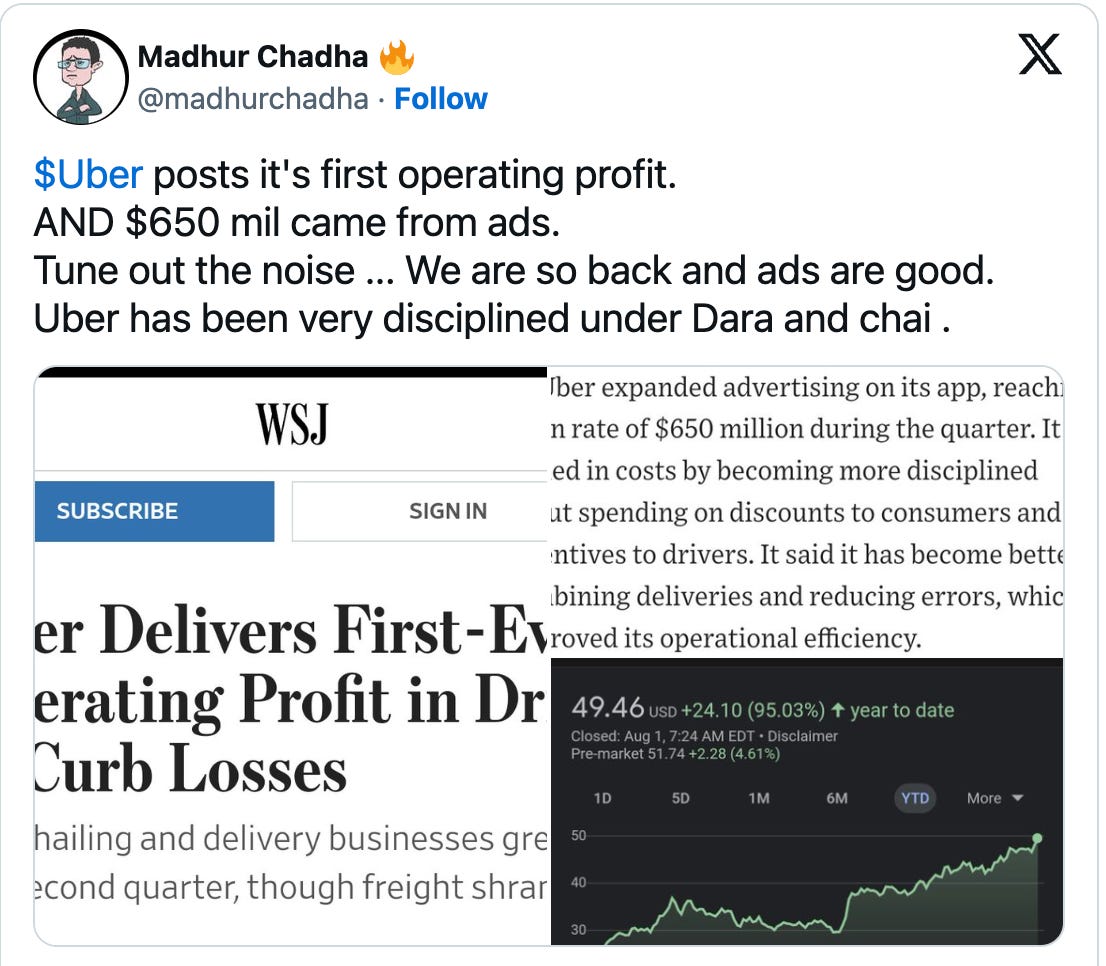

If you tuned in to Uber's earnings report, you'd know that the company recently achieved its first-ever operating profit, largely propelled by its robust ads network.

Uber runs advertisements within its suite of ride-sharing and delivery apps, even placing ads on tablets installed in drivers' cars, enabling it to monetise the considerable consumer attention it receives.

With an expected annual revenue exceeding $650 million, Uber anticipates that its advertising division could yield over a billion dollars by 2024.

Uber isn't alone in this endeavour.

Walmart experienced a 30% growth in ad revenue, reaching $2.7 billion last year, while Instacart, the online grocery delivery service, raked in $740 million in ad revenues in 2022, accounting for 29% of its annual revenue.

These changes, notably Apple’s App Tracking Transparency (ATT) privacy policy and Google's move to phase out third-party cookies in Chrome, have fundamentally altered the landscape of digital advertising.

Eric Seufert, General Partner at Heracles Capital, explains this shift via a compelling thread on X.

“Digital advertising's monolithic landmass of Google + Facebook is decomposing into a constellation of advertising platforms that don't rely (exclusively) on SDKs or pixels to pair user data with advertising outcomes. These new ad networks utilize first-party data,” wrote Seufert.

“In the absence of a feedback loop of deterministically identifiable (through cookies or device identifiers) conversion data, first party data aggregated through marketplace sales, like Instacart's, prevails. And that is playing out.”

Meta and Google have attempted to adapt to this shift, but it has allowed companies like Uber and Instacart to thrive by capitalising on their own, vast repositories of first-party data.

Furthermore, the value of their ads businesses have soared thanks to their contextual relevance. For example, an advertiser on Uber Eats knows that you're about to place a food order, making them more willing to invest as conversion rates rise.

Ultimately, as Seufert puts it, everything is (becoming) an ad network.

For the sports industry to fully capitalise on this transition, Broughton rightly underscores the need for a mindset shift.

He believes “…it’s not that our market isn't willing [or] isn't capable, it's that the business model that we have employed is not allowing for digital monetisation.”

“[This is] because we sent most the digital related monetisation and transactions to broadcasters [including Amazon, Google (YouTube), and Apple] or to [social media, like] Twitter (X), Instagram, and the like.”

Consequently, a significant portion of fan or 'customer' data, with the exception of ticketing information, is held by these platforms rather than the rights holders - as Spotify found out when negotiating terms with FC Barcelona.

As digital transactions are poised to surge nearly 50% in the next four years and traditional sponsorship continues to wane (primarily now made up of state-funded enterprises and gambling companies), rights holders must adapt quicker than the London black cabs did.

Firstly, they need to identify where they can enable digital transactions to cash in today. This will help them in building up a (greater) repository of contextual and first-party data, allowing them to benefit longer term, too.

As Uber and Instacart’s ad networks illustrate, when digital transactions are paired with fan or ‘customer’ engagement, it can become a valuable asset to sell to advertisers.

Of course, for the sports industry this won’t happen overnight, but it does provide the bull case for rights holders when considering investment into their own digital ecosystems - as well as a warning not to be the last cab off the rank.

Not yet a subscriber? Join 1000+ sports business leaders, from the PFL to Premier League, that read Sports Pundit every week to get impactful industry insights.

📚Further Reading: Google has confirmed that X (formerly Twitter) is set to use Google Ads Manager to participate in online auctions to sell its inventory.

JOB BOARD

Partnerships Planning Coordinator - Tottenham Hotspur (London, UK)

Strategic Communications Director - CAA Sports (London, UK)

Head of Partnerships - LiveScore Group (London, UK)

Director, Operations (Leagues Cup) - MLS (New York, US)

Manager, Partnership Sales and Marketing - NASCAR Roots (Florida, US)

Do you have a job you’d like to promote to the amazing readers of this newsletter? Drop me a note at andy@sportspundit.co